worknow | EoR Germany

Hire Top Talent in Germany, Compliantly and Effortlessly.

Your local Employer of Record expert for navigating German labor law with confidence. Stop letting bureaucracy slow down your growth.

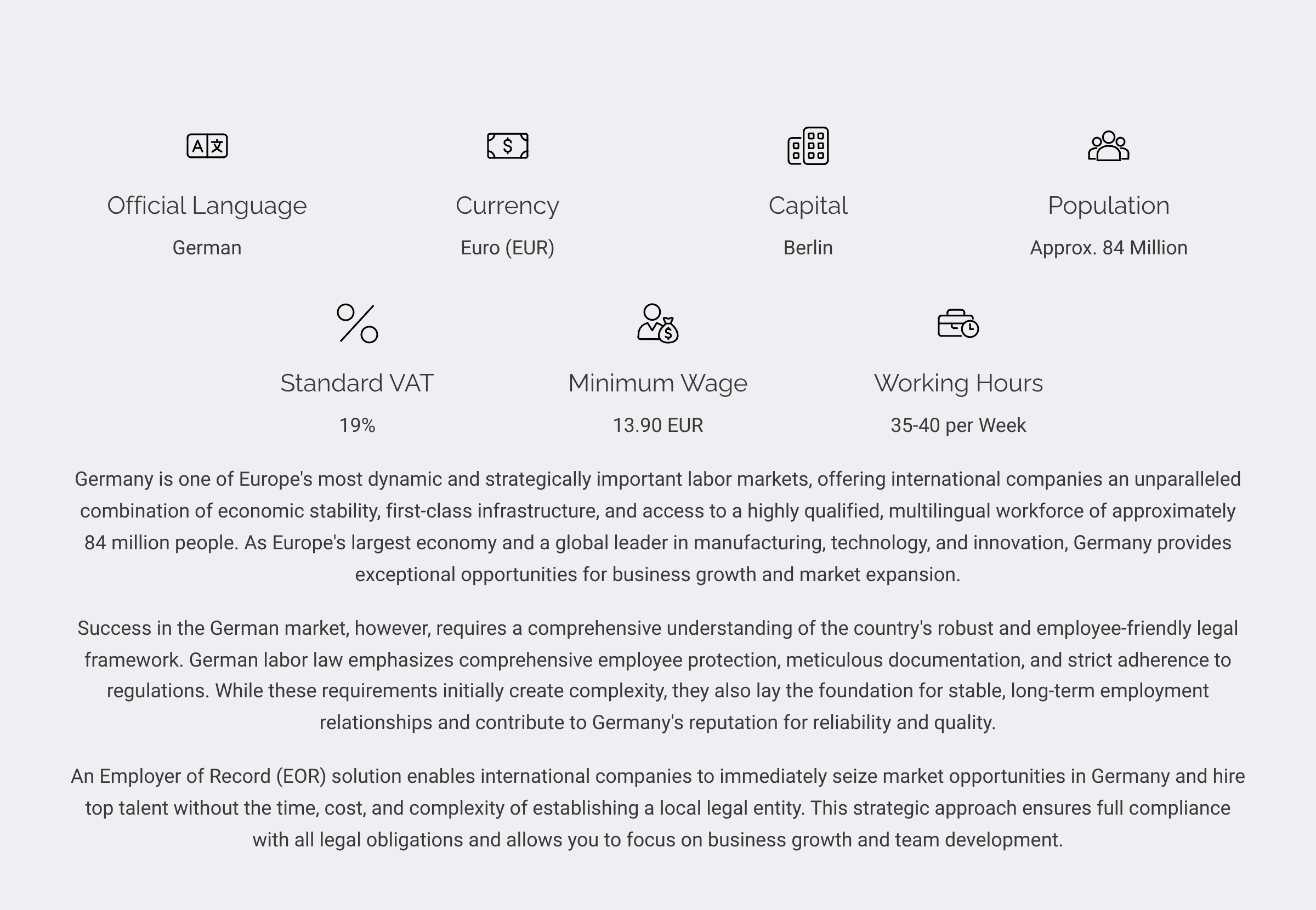

Welcome to Germany. Employment Information at a Glance

Capital

Berlin

Currency

EUR

Language

German

Public Holidays

10-12

Hours

35-40

Standard VAT

19%

Population

84 Mio.

Min. Wage

13.90 EUR

Average Salary

45,800

Germany: A Land of Opportunity... and Complex Labor Laws

Germany's thriving economy and highly skilled workforce make it a prime market for expansion. However, navigating its notoriously complex and strict labor laws can be a significant hurdle for international companies. From the Arbeitnehmerüberlassungsgesetz (AÜG) to intricate social security contributions and rigid data protection (GDPR) rules, a single misstep can lead to costly fines and legal disputes.

Strong Employee Protection

Hiring in Germany means navigating one of the most protective labor systems in the world — mistakes are costly.

Complex Employment Contracts

German employment contracts follow strict legal rules, with collective agreements partially applying and adding further complexity.

Employer of Record = AÜ

In Germany, the Employer of Record model is legally classified as employee leasing (AÜ) and requires an official license.

Strict Enforcement of the AÜ Act

The German AÜ Act is actively enforced, with audits, fines, and significant compliance risks.

VIEW AÜ LICENSE —Germany Employment Guide

What a compliant Employer of Record must handle in Germany

A compliant Employer of Record in Germany must navigate strict labor laws, complex payroll rules, and close coordination with authorities. End-to-end compliance is not optional — it’s essential.

Employment & Labor Law

Employment of your workforce in full compliance with German labor law, based on the EOR / AÜG model.

Payroll & Statutory Contributions

End-to-end payroll processing, including salary payments and the calculation and remittance of taxes and social security contributions.

Contracts & Documentation

Preparation and ongoing management of employment contracts, contract amendments, and all required labor-law-related documentation.

Compliance & Authorities

Ensuring full labor-law compliance and handling coordination and communication with all relevant authorities.

What Can Go Wrong with the Wrong EOR

Germany is not forgiving when it comes to mistakes in employment compliance. Choosing an inexperienced or careless EOR can result in severe consequences. For these reasons, companies should carefully assess an EOR’s local expertise, licensing, and operational presence before entering the German market.

FAQs

- Discretionary Nature: Any rewards or incentives are treated as purely discretionary payments initiated by the client. These are not part of the core contractual salary obligations of worknow GmbH.

- The Pass-Through Model: We act solely as a technical processing agent. A payout can only be facilitated if the client explicitly requests it and provides the necessary funds in advance.

- Budgeting for Ancillary Costs: Please be aware that the total cost for a bonus includes the gross amount plus approximately 25% in employer-side contributions (social security, etc.).

- Execution only upon Funding: worknow GmbH will process the payment through the next available payroll once the full amount (including all employer costs) has been secured.

You send us a short email outlining your hiring plans in Germany, including who you want to hire, for which role, the intended start date, the planned salary and the expected duration of employment.

Based on this information, worknow reviews feasibility and, in most cases, completes the entire setup within 3–5 business days. Where required, we are also able to progress steps over weekends to meet tight timelines. Throughout the process, you are supported by a dedicated contact to ensure a compliant, transparent and straightforward setup.

Don't Just Be Compliant. Be Confident.

Hiring an EOR provider without the necessary Agentur für Arbeit authorization can expose your business to serious risks. Under German law, you could face subsidiary liability, meaning you could be held accountable for any violations of labor, tax, or social security laws committed by your provider. This could result in hefty fines and unexpected back payments.

Navigation

Legal

Contact

worknow GmbH

Schlüterstraße 37

D-10629 Berlin

info@w-now.de

worknow.

Copyright 2026 @ worknow GmbH